Ο Ομότιμος Καθηγητής Οικονομικών του ΕΚΠΑ, Π.Ε. Πετράκης, έδωσε την ακόλουθη συνέντευξη στο Economy Chosun, το κορυφαίο περιοδικό επιχειρηματικότητας και οικονομικών της Ν. Κορέας. Ακολουθεί η συνέντευξη στην αγγλική γλώσσα.

1.Greece is an example of a country that once fell into the middle-income trap. Why did Greece, which once had a GNI of $29,000, fall into the “middle-income trap”?

The concept of the middle-income trap is somewhat ambiguous, especially when considering the established income limits (ranging from $2,000 to $12,000 per capita GNI), which are quite distant from Greece’s GNI. Therefore, it doesn’t appear that this trap was the sole cause of the 2010 crisis. Instead, I believe the crisis can be attributed to several factors, including the excessive expansion of the non-tradable sector in the Greek economy, high levels of indebtedness in both the public and banking sectors, and a rapidly changing global landscape marked by increased internationalization and intensified competition in traditional industries. Additionally, the Greek economy struggled with operational constraints that hindered its ability to offer a wider range of products and services.

One prominent aspect of the problem was the public debt burden, rooted in a populist approach inherited from the military dictatorship period (1967-1974) and the social liberal policies of the 1981-1996 era. Even though social modernization occurred afterward, it didn’t change the economy’s institutional framework and attitude significantly, and sometimes aggravated it. Consequently, when the global financial crisis of 2008 hit, it exposed all the vulnerabilities accumulating, ultimately leading to a catastrophic outcome.

2. Once on the brink of default, Greece’s economy is recovering rapidly. What turned Greece around?

The answer to this question can be analyzed on two primary levels. The first level involves the three stabilization programs implemented between 2010 and 2018, closely monitored by the European Commission, the European Central Bank, and the International Monetary Fund. These programs aimed to achieve internal devaluation, resulting in a significant reduction in the standard of living, which has been gradually recovering. It’s worth noting that during this period, efforts were also made to clean up the banking system from bad loans (amounting to around 90 billion euros), making the recovery process more challenging. Additionally, the housing market, traditionally a crucial pillar of the Greek economy, fall in recession. In return for these measures, Greece benefited from a well-structured regulation of its public debt. It features a long maturity period (around 17 years) and a substantial grace period (until 2052) with a significantly reduced annual debt service burden.

The second level of analysis pertains to the willingness of Greek society to accept and adapt to the demanding conditions imposed on it, even though they were burdensome. Despite the challenges, Greece strongly committed to maintaining its ties with Europe and the Western world. Surprisingly, the third memorandum was signed by a left government and received support from a parliament where 75% of the Members of Parliament favored continuing the relationship with the represented institutions and the inflow of European assistance.

In conclusion, the gradual recovery of the Greek economy can be attributed to the prevailing economic and political environment. Furthermore, Greece’s economic structure significantly emphasizes the service sector, particularly tourism (exports). Consequently, the tradable sector of the economy had a relatively low break-even operating point survival during the crisis. Furthermore, during the coming decade, growth will be based on an improved efficiency/demand model mirroring to an extent the experiences of other Mediterranean countries, although on geostrategic grounds, Greece seems to have some future advantages (the last west frontier of the South – East European World).

3. Is it safe to say Greece is out of the middle-income trap now? The European Commission forecasts that economic growth will moderate to 1.9% starting in 2024.

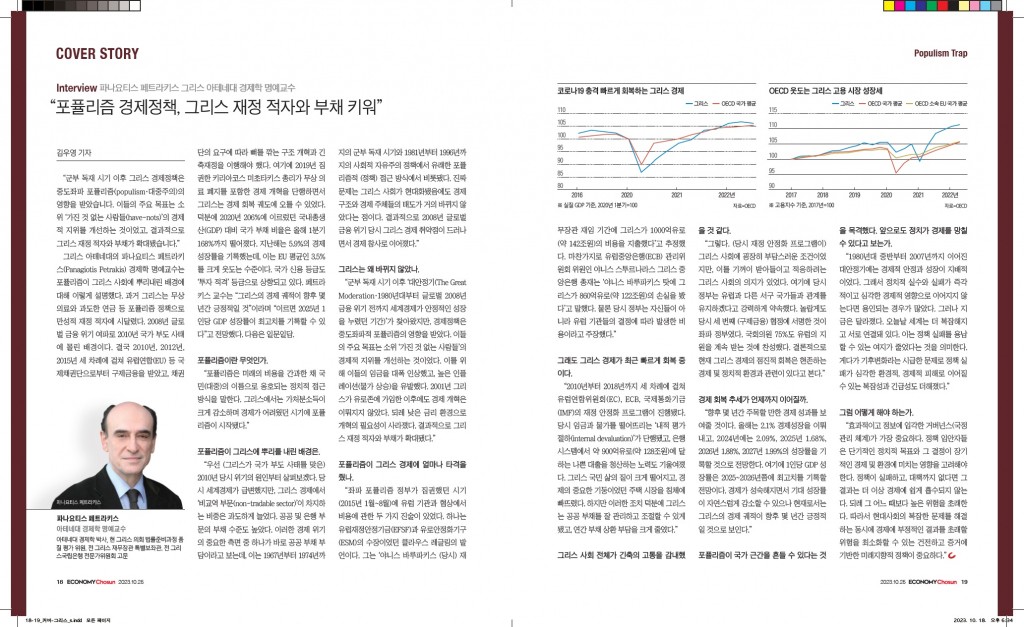

Greece’s real GDP growth rates and outlook for the coming years suggest a notable economic performance compared to many Central European economies. In 2021, Greece achieved an impressive growth rate of 8.43%, followed by a still robust 6.01% in 2022. Expectations for 2023 indicate a slight slowdown with a projected growth rate of 2.1%, and this trend continues into 2024, where growth is anticipated to be around 2.09%. Further deceleration is expected in 2025, with a growth rate of 1.68%, before a modest rebound to 1.88% in 2026, and reaching 1.99% in 2027.

However, this performance suggests that Greece may be experiencing a period of overperformance compared to Central European economies. Some assessments suggest that the period from 2012 to 2035 could be the 7th historical growth wave for the Greek economy. GDP per capita is expected to peak growth around 2025-2026, after which the rate of change may decline.

When looking at similar estimates for the Eurozone, it’s evident that Greece’s growth rate is expected to be higher and more resilient. This contrasts concerns about the predicted secular stagnation before the COVID-19 pandemic and the Ukrainian crisis. One would expect a natural reduction in expected growth rates as economies mature. However, Greece’s economic trajectory appears to defy this trend, at least for now, with a positive outlook for the coming years.

4. Do you think Greece’s economic growth will continue for the foreseeable future as long as Prime Minister Kyriakos Mitsotakis is in power? What could be the variables in the future? Is it the energy crisis?

The future of Greece will be influenced by several critical factors shaping its economic landscape in the coming decade. Some of these key issues include: (a) Environmental Concerns: Greece, like many other countries, must address environmental challenges such as climate change, sustainable energy, and natural resource management. Transitioning to a more environmentally friendly economy will be vital. (b) EU Enlargement in the Balkans: The prospect of EU enlargement in the Balkans can have significant implications for Greece, affecting trade, geopolitics, and regional stability. (c) Chinese and Indian Presence: The growing presence of China and India in the region, both economically and strategically, will likely impact Greece’s trade relationships and global positioning. (d) Interest Rates: Fluctuations in interest rates can substantially impact Greece’s borrowing costs and overall economic stability. (e) Geostrategic Positioning: Greece’s new position on the geostrategic and energy maps of Europe and the Mediterranean will shape its role in regional politics and economics. (f) European Funds: The effective utilization of European Union funds will play a vital role in Greece’s economic development and infrastructure improvement. (g) Population Trends: Greece’s shrinking population challenges labor markets, social services, and economic growth. (h) Real Estate Development: The development of real estate, including tourism and property markets, will be a significant driver of economic activity. (i) Foreign Policy: Greece’s foreign policy, including its relationships with neighboring countries, the European Union, and NATO, will impact its economic and geopolitical standing; Greece’s relationship with Turkey is complex and influential, with potential consequences for regional stability, military expenses, trade, and energy resources.

Prime Minister K. Mitsotakis’ commitment to prudent financial management is crucial, particularly during economic uncertainty and geopolitical instability. Effective leadership in navigating these complex challenges will be essential for Greece’s future prosperity and stability.

5. South Korean media chose this title for the results of the second general election in June of this year. “Greek voters tired of populism chose the economy.” “Greek voters rejected populism.” Are these analyses correct? What is the actual mood of the Greek people? What has been the impact of populism on the Greek economy? Why can’t voters move on from populism

Populism, a political approach often championed in the name of the people while overlooking future costs, took root in Greece during a particularly challenging period, primarily marked by a significant reduction in disposable income. However, the turning point in 2015, when the populist government of the time-shifted toward a more European-oriented perspective, and subsequent political reversals by populist parties have made it challenging for populism to regain its foothold in Greek politics fully.

As a result, the main opposition to the current government in Greece appears to stem from the shortcomings within its administration and the opposition’s limitations. Over time, it becomes increasingly crucial for the government to enhance its administrative capacity, particularly as asymmetric threats like climate change become more prominent, demanding effective management and policymaking.

In this evolving political landscape, the focus is shifting toward governance, competence, and the ability to address complex challenges. Greece must develop its administrative capabilities to tackle traditional issues and emerging global challenges that require astute management and forward-thinking policies.

6. Right-wing parties are winning elections in Greece, Italy, and Spain. Why do you think right-wing parties are gaining power across Europe regarding economic reform?

The rise of right-wing parties in Europe can be attributed to several factors, including immigration, the Ukrainian issue, and inflation. These factors have fueled concerns among specific population segments, leading them to support right-wing parties.

Additionally, the fact that this trend predates the significant economic crisis of 2008 has eroded confidence in the institutional capacity of economies to handle significant crises effectively. As a result, there is a growing sentiment among the public that some form of state intervention may be necessary to manage such crises, even though these views often resist reform policies.

7. To summarize what we have seen, is there a correlation between “political failure” and “economic crisis”?

Your statement highlights an important and complex issue, which has been extensively studied and analyzed in the context of various countries and different periods. The relationship between political decisions and economic outcomes is of great interest and significance.

In the past, during the period known as the “Great Moderation” from the mid-1980s to 2007, economic stability and growth seemed to dominate, often allowing for political mistakes and failures without immediate and severe economic consequences. However, in today’s world, characterized by greater complexity, interconnectivity, and the urgent challenge of climate change, the tolerance for policy failures has significantly diminished.

The globalized and interconnected nature of the world means that political decisions can have far-reaching economic consequences. Moreover, the pressing issue of climate change adds a layer of complexity and urgency, where policy failures can lead to significant environmental and economic damage.

In this context, the need for effective and informed governance becomes paramount. Policymakers must consider short-term political goals and their decisions’ long-term economic and environmental impacts. The consequences of policy mistakes or inaction are no longer easily absorbed by the economy, and the stakes are higher than ever. Therefore, there is a growing demand for sound, evidence-based, and forward-thinking policies that can address the complex challenges of the modern world while minimizing the risk of adverse economic outcomes.

8. I’m wondering what the central populist policies contributed to Greece’s financial problems in the past and how much they hurt the economy (because it’s hard to find specific data in my country).

The question is quite challenging to answer scientifically. However, during the phase of the great crisis of 2015 (January – August 2015), under the left-wing populist government, there were two statements concerning the “cost” of negotiating with the European institutions: One was from Klaus Regling, head of the European Financial Stability Facility (EFSF) and first managing director of the European Stability Mechanism, who estimated that “Varoufakis’ FinMin tenure cost Greece 100 billion euros”. Similarly, Central Banker Yannis Stournaras, an ECB Governing Council member, stated, “Varoufakis’ strategy cost Greece 86 billion euros”. Of course, the government’s response at the time to these estimates was that this cost, which no one disputed, was due to the decisions of the European institutions and not the decisions of the Greek government. I believe that the cost was ultimately caused by the issues (negotiation) that were aimlessly and without purpose, based on “delusions” (statement by A. Tsipras, Prime Minister) raised (e.g., euro exit etc). It is worth noting that Greece had already been on a recovery trajectory since 2014 that was interrupted. Furthermore, the Third Memorandum had a specific expiration date, and with the 2019 elections, we entered a phase of substantial recovery that continues to this day.

9. The second additional question is that, as you answered in question 1, I’m wondering why the institutional framework and attitude of the economy didn’t change after the military dictatorship and social liberal policies era.

The second question is of particular interest. The economic policy that prevailed after the dictatorship, influenced by the international positive environment of the Great Moderation, also had populist elements, but this time with a center-left origin. Its main goal was to improve the “have-nots” economic position (significant wage increases – high inflation). Modern economic policy elements began to be adopted after joining the euro (2001) but at a very slow pace. The institutional framework did not change significantly, while the low-interest-rate environment “lulled” the need for significant reforms, leading us to excessive public deficits and debt. Substantial economic reforms were introduced from the memoranda (2010) onwards. Since then, there has been an unwavering political and social need to expand the adoption of reforms with very good economic results.”

Πηγή: Economy Chosun

Δείτε την αναδημοσίευση στο In Deep Analysis: http://indeepanalysis.gr/oikonomia/synentefksi-sto-economy-chosun